While counties are in the full swing of construction season, the County Road Administration Board is hard at work every summer to provide counties with accurate estimates of the funds they can anticipate the following calendar year.

It is a comprehensive process that requires detailed analysis of transportation revenue forecasts, review of distribution factors, and approvals from our board. The final Motor Vehicle Fuel Tax (MVFT) and County Arterial Preservation Program (CAPP) distribution estimates that are published and sent to counties in July have been reliable and valuable tools for counties to base their upcoming year’s budgets and projects on for years.

However, recently there was a big change in WHO is preparing the underlying transportation revenue forecast they are based on and, even more importantly, HOW they are being prepared. In 2023, the Legislature adopted ESHB 1838, transferring the responsibilities for the transportation revenue forecast from WSDOT to the Economic and Revenue Forecast Council (ERFC), who was already providing the general revenue forecasts for the state’s general fund and capital budgets. During the transition from September 2023 to September 2024, revenue forecasts were published using WSDOT's calculations, but the forecasted revenue to counties was unchanged.

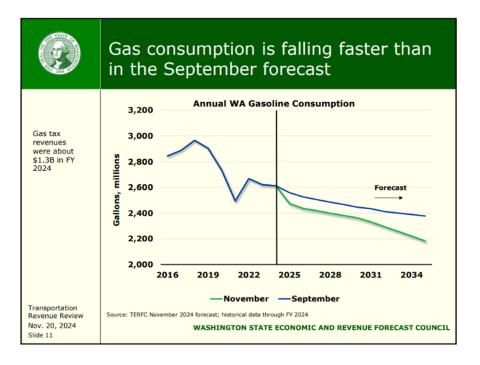

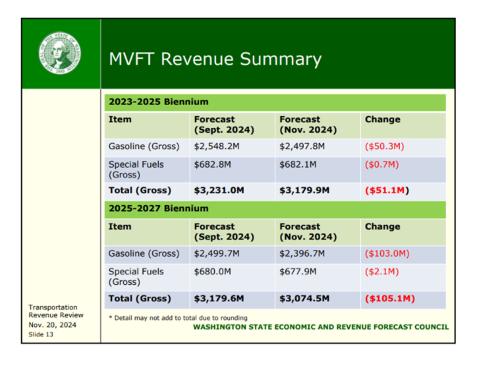

The September 2024 transportation revenue forecast was the first forecast issued by the ERFC and, unfortunately, the news is not good. This was magnified by the November forecast, which showed the rate of decline in MVFT revenues is accelerating. From June to November, the 2023-2025 biennium transportation revenue estimate to counties decreased $10.7 million and the 2025-2027 biennium forecast decreased another $28.6 million. Gas consumption, which is our single largest transportation revenue source at $1.6 billion this year, peaked in 2018 and has already fallen another 5.8% year over year, according to the ERFC.

It highlights the accelerating decline in MVFT resulting from slowing growth, more fuel-efficient vehicles, and the move to electric vehicles. The impact to county roads will be painful. All of Washington’s 39 counties receive monthly direct distributions to the county road departments for the maintenance, preservation, operations and administration of their county road system. It is one of, if not the largest, revenue source for funding roads in every county.

The June forecast that we based our estimates off of, placed the counties’ distribution of MVFT in 2025 at $136.29 million. The November forecast reduced it to $124.48 million in 2025, an 8.7% drop. The story is similar for CAPP distributions, where estimates were lowered to $12.99 million, an 8.6% drop. The implications of these changes are significant for counties, who have been stretching limited road budgets for years.

There is nothing surprising about the decline in fuel tax revenues. The writing has been on the wall for years and stakeholders have been pushing policy makers to create a plan for it’s inevitable decline. However, seeing the financial cliff approaching is sobering.

While we can’t make money grow on trees, we here at the County Road Administration Board want to assist in any way we can. We have revised estimates available for each county on our website where the most current information can be found.

But, the news is not all bad. We have some good news to share about a correction we have been working on with the State Treasurer's Office. The resulting change will increase the amount of MVFT distributed to the counties and will, hopefully, soften the blow of decreasing total MVFT collections. With this correction, the counties are now forecasted to receive $132.5 million in 2025 resulting in a 2.8% drop from the June 2024 revenue estimate. While it is a drop in forecasted revenue, it is much better than the 8.7% drop previously forecasted.

We will continue to provide information as it becomes available and welcome our county partners to reach out with any questions.

Drew Woods

Deputy Director